Events are unfolding quickly, so pay attention.

the gold standard 2.0 is being adopted now

the days of the US$ as the world’s reserve currency are over

the new reserve currency will be digital and back by hard assets like gold and other commodities

paper gold markets like LBMA / COMEX will lose their ability to manipulate the price of gold and likely crash. Expect massive fraud to be exposed in the process. This will threaten all global financial markets.

These are long overdue developments to the proponents of sound money and the gold standard - but it comes with an enormous threat to privacy and freedom.

You see, tyrants will try and build controls into the digital currency to track every dollar you receive and spend, and build in the ability freeze or confiscate your money at a moments notice if you think or act in ways that do not meet with their approval.

If that sounds crazy to you, bear with me - I am going to explain

The Emperor Has No Clothes

Blind Freddy can see the role of the US$ as the world’s reserve currency is a fraud. Even the most financially illiterate of us know, you cannot keep spending more money then you earn each year - year after year after year. But that is exactly what the USA has been doing for decades.

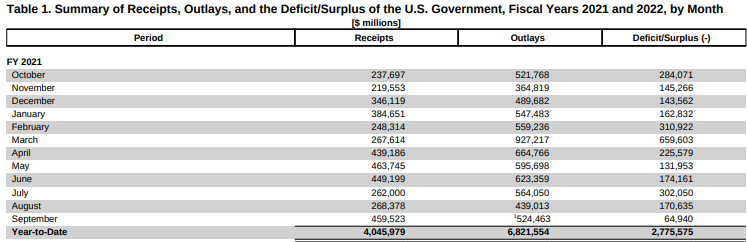

Just have a look at this table below to Receipts and Outlays for 2021. It shows the government received $4.045 trillion from all sources but spent $6.821 trillion. So in 2021 alone it spent $2.775 trillion more then it received.

Put in simpler terms, in 2021 the USA government spent $1.68 for every dollar it received. Think about it in terms of your personal budget. I your paycheck is $1,000 a week - how long could you keep spending $1,680 a week before you were forced into bankruptcy.

This is why the USA owes over $30 trillion dollars today. Or at least that is what the government admits to owing. It owes trillions more in future promises for social security, medicare, government pensions, etc.

But the elite ruling class in the USA, drunk with power, corrupt, and compromised just keep spending more and more at a faster and faster rate. Take a look at the graphic below showing receipts and outlays for February 2022. The government received $290 billion and spent $506 billion. Or more simply put, for every dollar the USA government received in Feb 2022, it spent $1.74 (compared to $1.68 in 2021)

Just as you can see this situation is not sustainable, governments around the world who have traditionally stored funds in US$ - either for security or trade - know this situation in unsustainable and are unwilling to bear the risk of a massive devaluation in the US$ when the music stops. 100 years ago, even 50 years ago, the options available to these countries were very limited. Today that has changed because:

there is a lot of financial expertise outside of the USA

speed of communication, exchange rate conversion, and transmittal of funds is much faster

the emergence of cryptocurrencies

technology in general

Plus the arrogant ruling class have decided to weaponize the US$, SWIFT payment system and other parts of the financial markets. Other countries no longer believe the money they place in the USA will not be held ransom should they do something the USA does not agree with. Why would they expose themselves to this risk?

That is why we are seeing the adoption of what I am calling the Gold Standard 2.0

The Gold Standard 2.0

Ronan Manly illustrates this in his article entitled Russian Ruble relaunched linked to Gold and Commodities He explains how Russia’s central bank has profoundly altered the international trade and monetary system by linking the Russian ruble to both gold and commodities:

By offering to buy gold from Russian banks at a fixed price of 5000 rubles per gram, the Bank of Russia has both linked the ruble to gold and, since gold trades in US dollars, set a floor price for the ruble in terms of the US dollar.

Putin is demanding that foreign buyers (importers of Russian gas) must pay for this natural gas using rubles. This immediately links the price of natural gas to rubles and (because of the fixed link to gold) to the gold price. So Russian natural gas is now linked via the ruble to gold.

This can be applied to any commodities, not just natural gas. For example, if Russia begins to demand payment for oil exports with rubles, there will be an immediate indirect peg to gold (via the fixed price ruble – gold connection). Then Russia could begin accepting gold directly in payment for its oil exports.

Since 1971, the global reserve status of the US dollar has been underpinned by oil, and the petrodollar era has only been possible due to both the world’s continued use of US dollars to trade oil and the USA’s ability to prevent any competitor to the US dollar.

If Russia begins to accept gold directly as a payment for oil, this would link the oil price directly to the gold price. Russia could start by specifying that it will now accept 1 gram of gold per barrel of oil. Buyers would then scramble to buy physical gold to pay for Russian oil exports, which in turn would create huge strains in the paper gold markets of London and New York where the entire ‘gold price’ discovery is based on synthetic and fractionally-backed cash-settled unallocated ‘gold’ and gold price ‘derivatives.

Western sanctions such as the freezing of the majority of Russia’s foreign exchange reserves while trying to sanction Russian gold have now made it obvious that property rights on FX reserves held abroad may not be respected, and likewise, that foreign central bank gold held in vault locations such as at the Bank of England and the New York Fed, is not beyond confiscation.

Look at who, apart from the US, are the world’s largest oil and natural gas producers – Iran, China, Saudi Arabia, UAE, Qatar. Obviously, all of the BRICS countries and Eurasian countries are also following all of this very closely. If the demise of the US dollar is nearing, all of these countries will want their currencies to be beneficiaries of a new multi-lateral monetary order.

Chess versus Checkers

Putin the chess master, did not do this on the spur of the moment. It has been long thought out and the ground well prepared:

Selling energy to Europe to ensure they were hostage to the demands of Russia to be paid in Rubles.

Building up Russia’s reserves so it can withstand short term turmoil.

Has probably war gamed with with America’s enemies.

Waiting patiently, ready to pounce as soon energy prices were high enough.

Meanwhile over in the dementia wing, Joe Biden drove up the price of oil and natural gas with foolish checker moves like:

Making the USA dependent on the rest of the world for it’s energy

Canceling the Keystone Pipeline and others

Stopping exploration leases of federal lands

Using environmental regulation to attack the carbon based energy industry.

Neglecting the Abraham Accords and enabling Iran to re-establish itself to other Middle Eastern oil produces like Saudi Arabia and the Emirates with the result

The leader of Saudi Arabia will not even take a phone call from Joe Biden, let alone help by producing more oil to keep the price lower.

Impose sanction of Russian energy exports making the world scramble to find oil and gas and bidding up the price in the process.

Unilaterally disarmed the USA by locking his administration into Green New Deal policies that it would be politically impossible to be reversed under his Presidency.

It will take time to transition to the Gold Standard 2.0 and Joe Biden has given the world plenty of time to transition. It would take a new President (probably from the other side of politics) to unwind his policies - so 2024 at the earliest. And it would take 2 or 3 years for those policies changes to have a meaningful effect.

So Joe Biden has given the world 5 years to transition from using the US$ as a global reserve currency to the Gold Standard 2.0.

The Gold Standard 2.0 - not just the metal

As you have probably surmised from the above discussion, The Gold Standard 2.0 will not just be based on the precious metal Gold, but tangible commodities like oil, gas, iron ore, rare metals, agricultural products etc. Paper that can churn out of central bank printing presses or be manufacture in world financial markets will not cut it any more.

Putin has shown resource based economies how to do it, by tying the Ruble to Gold and Natural Gas. He will probably expand this to other resources he exports, while other resource economies will be looking to tie their currencies to the basket of commodities they export. These efforts will all support each other, intentionally or not. They will all reduce the role of the US$ as the world’s reserve currency. In turn the value of the US$ will reduce, US inflation will rise, and interest rates rises will follow. This will be an unpleasant time for the US economy.

The Gold Standard 2.0 will be Digital

The blockchain will underlie the Gold Standard 2.0. It will be a Digital Currency and this will:

threaten the world’s major financial institutions

Mastercard, Visa Card, Discover, American Express - will probably not be needed and merchants will be glad not to have to pay them a share of every transaction

Savings and Checking Accounts will no longer be needed - think of all those people employed in bank branches. Where will the banks get the money from to lend to others?

What control if any will central banks have over the Gold Standard 2.0

Pose a major threat to our privacy and freedom because the ruling class will try to build controls into the digital currency that will allow them to:

track everything your receive and spend.

tax you.

freeze or confiscate your funds if your actions or thoughts are not approved by them, etc.

Brandon Smith outlined these threats to our privacy and freedom in an article called What Is The “Great Reset” And What Do The Globalists Actually Want? where he said:

The ultimate goal of full centralization is to erase the very idea of free markets and to allow a handful of people to micromanage every aspect of trade and business. It’s not just about influence, it’s about economic empire. But in order to achieve a global central bank they must first implement a one world currency plan.

On the micro-economic side, each and every individual would now be dependent on a digital currency or cryptocurrency which removes all privacy in trade. All transactions would be tracked, and by the very nature of blockchain technology and the digital ledger this would be required. The money elites wouldn’t have to explain the tracking, all they would have to say is “That’s how the technology functions; without the ledger it doesn’t work.”

Imagine if they had the power to simply shut down your ability to get a job, to shop in grocery stores and even shut down access to your money? Without your compliance to the collective, access to normal survival necessities would be impossible.

The truth is a rare commodity these days, but nowhere near as rare as it will be if these elitists get what they want. The globalists are far more open about their agenda today than they have ever been before, and I suspect this is because they believe they will be able to rewrite the history of today’s events with impunity after the Reset unfolds. They think they will own the world of information and will be able to edit our cultural memory as they go.

Build Freedom and Privacy into the Digital Currency instead

If I give you a quarter (25 cents), who know except you and I? Nobody, it is private. I am free to give the quarter to whoever I want for any (legal) reason I want.

The government does not track when that quarter changes hands, or deducts a tax of say 20% automatically. Nor can the government cast a spell on that particular quarter I have in my hand and make it worthless because I said or thought or did something the government does not agree with.

This is the way currencies have worked since the dawn of time and we must fight to make sure the Gold Standard 2.0 Digital Currency works the same way.

Governments will fight this to say they need to be able to track each transaction to stop drug dealers or money launders or tax cheats etc. But these so called benefits are not enough to offset the very real threat to our freedom and privacy.

We do not need to reinvent the wheel here - there are already cryptocurrencies that are private, decentralized and keep your finances confidential and secure. Check out Monero for example:

Monero focuses on private and censorship-resistant transactions. Many cryptocurrencies, including Bitcoin and Ethereum, have transparent blockchains. Transactions can be verified and/or traced by anyone in the world. This means that the sending and receiving addresses of these transactions could potentially be linked to real-world identities. Monero, on the other hand, uses various privacy-enhancing technologies to ensure the anonymity of its users.

Every transaction is private so Monero cannot be traced. This makes it a true, fungible currency. Merchants and individuals accepting Monero do not need to worry about blacklisted or tainted coins.

Monero is electronic cash that allows fast, inexpensive payments to and from anywhere in the world. There are no wire transfer or check clearing fees, no multi-day holding periods, and no fraudulent chargebacks. Because Monero is decentralized, it is not constrained by any particular legal jurisdiction and provides safety from capital control.

This video gives you a good overview of what Monero is and how it works.

Conclusion

The move to sound money like The Gold Standard 2.0 is long overdue and should be embraced. It is long overdue and the transition will not come without pain, especially for the ruling class who have rigged the current system to their advantage and to the disadvantage of the working class.

Do not let the ruling class distract you with their squeals. They do not want to give up money and power and will fight it every step of the way. But this transition is out of their control (as well as yours and mine) and will happen regardless. So embrace it and prepare for it.

Innovation and change is not without risk. The biggest risk to you and I is the ruling class will try and build controls into the digital currency to control your thoughts, speech, and behavior. Do not let them. We already know from cryptocurrencies like Monero that a well designed digital currency to enhance our privacy and and protect our freedom.

Resources to stay up to date:

We post and discuss links to the latest articles are Exploding Heads:

https://exploding-heads.com/c/cryptoaslegaltender

https://exploding-heads.com/c/digitslfreedom

https://exploding-heads.com/c/cryptoprivacy

Finally if freedom and privacy are important to you, I would encourage you to read our post on Digital IDs.

Final Thought

This offers an enormous opportunity to a well respected, democratic, resource based economy to launch a Digital Currency based of a basked of resources. But to take advantage of the opportunity, their digital currency must respect privacy and freedom.